Accounting methodis the method required under GAAP. In the long-term assets section of the balance sheet OB.

Solved The Matching Principle Requires Businesses To Record Chegg Com

Matching principle is the accounting principle that requires that the expenses incurred during a period be recorded in the same period in which the related revenues are earned.

. FMVA - Required 25h Scenario Sensitivity Analysis in Excel. Experts are tested by Chegg as specialists in their subject area. Is a business estimates bad debts expense instead of waiting to see which customers the company will not collect from.

At the time of the sale the company does not know the exact amount of warranty. The correct answer is D in the same period that the company records the reve. When a customer pays on an account that has been written off the company needs to reverse the write-off to the Allowance for Bad Debts account and then record the receipt of cash.

Warranty expense is an expense related to the repair replacement or compensation to a user for any product defects. Report as a non-current liability when they. Apply the percentage obtained under step 1 to the total sales undertaken by the business during the.

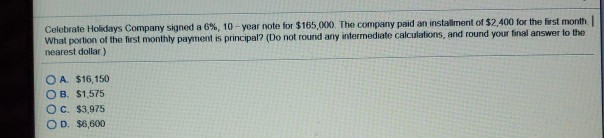

The expense therefore is incurred when the company makes a sale not when the company pays the warranty claims. Further it results in a liability to appear on the balance sheet for the end of the accounting period. How much of the note payable should Peligrino Co.

Because of the terms specified this extendedseparate warranty does not become active until January 1 Year Two. Warranty expenses are usually recorded through a four-step process. This is called the matching principle where all expenses related to a sale are recognized in the same.

View the full answer. This opinion affirms the auditors judgment that reports are accurate and conform to. Adjusting Entries Adjusting entries are made at the end of the accounting period to record revenues to the period in which they are earned and expenses to the period in which they occur.

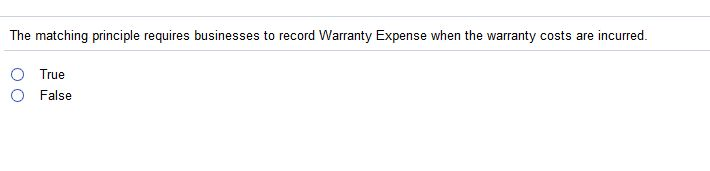

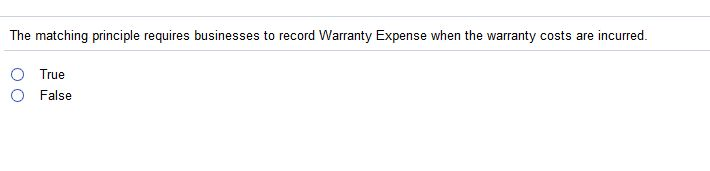

As explained by the matching principle no expense is recognized until the revenue begins to be reported. The matching principle requires businesses to record Warranty Expense when the warranty costs are incurred. The matching principle directs a company to report an expense on its income statement in the period in which the related revenues are earned.

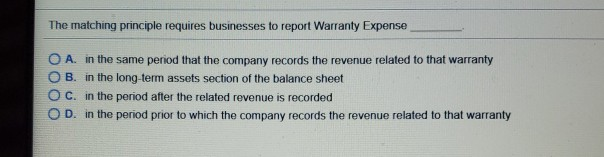

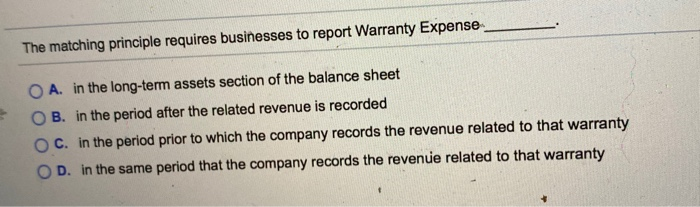

Warranty expense is subject to the matching principle which means it is reported against revenue. We review their content and use your feedback to keep the quality high. The matching principle requires businesses to report Warranty Expense O A.

The matching principle requires businesses to report Warranty Expense _____ a. The matching principle requires businesses to report Warranty Expense O A. The expense therefore is incurred when the company makes a sale not when the company pays the warranty claims.

In the long-term assets section of the balance sheet C. The matching principle requires businesses to record Warranty Expense in the same period that the company records the revenue related to that warranty. In the period after the related revenue is recorded.

In the period after the related revenue is recorded O c. The matching principle requires businesses to record Warranty Expense in the same period that the company records the revenue related to that warranty. O True O False.

March 28 2019. The journal entry to record the work should be a debit of 800 to Warranty Expense and a 800 credit to Estimated Warranty Liability. In the long-term assets section of the balance sheet C.

The matching principle requires businesses to report Warranty Expense _____ in Business. Note that no expense was estimated and recorded in connection with this warranty. Matching principle is an accounting principle for recording revenues and expenses.

The matching principle requires businesses to record Warranty Expense in the same period that the company records the revenue related to the warranty. Total amount debited to Treasury Stock - Common No. Note that no expense was estimated and recorded in connection with this warranty.

How to Account for Warranty Expense. In the period prior to which the company records the revenue related to that warranty b. The matching principle requires that the total interest expense be allocated from AA 1.

The matching principle requires businesses to. In the long-term assets section of the balance sheet c. FMVA - Required 75h Business Valuation Modeling Part I.

FALSE The matching principl. The matching principle requires businesses to report warranty expense in thethat the company records the revenue related to that warranty. In the period prior to which.

Indicate whether the statement is true or false. In the same period that the company records the revenue related to that warranty O B. The matching principle is associated with the accrual basis of accounting and adjusting entries.

The matching principle requires businesses to report warranty expense _____. January 25 2022 thanh The matching principle requires businesses to report Warranty Expense O A. It requires that a business records expenses alongside revenues earned.

As explained by the matching principle no expense is recognized until the revenue begins to be reported. This principle recognizes that businesses must incur expenses to earn revenues. Warranty expense is recognized in the same period as the sales for the products that were sold if it is probable that an expense will be incurred and the company can estimate the amount of the expense.

Of shares purchase price per share 40000 1200 480000. Ideally they both fall within the same period of time for the clearest tracking. The matching principle requires businesses to record Warranty Expense when the warranty costs are incurred.

View the full answer. Use the historical data to determine the actual claims against the sales undertaken. Because of the terms specified this extended warranty does not become active until January 1 Year Two.

A in the same period that the company records the revenue related to that warranty. Which of the following accounting principles requires that warranty expense must be estimated and recognized in the same period when the related sales revenue is recognized. In the period after the related revenue is recorded O D in the period prior to which the company records the revenue related to.

The television is then covered for a three-year period. A Treasury StockCommon is debited for 480000. In the same period that the company records the revenue related to that warranty O B.

The matching principle requires businesses to report Warranty Expense _____. This principle recognizes that businesses must incur expenses to earn revenues. The matching principle requires businesses to report Warranty Expense _____.

Accounting for warranty expense and warranty payable. Usually the data needs to be for a good number of years to get a better idea.

Solved The Matching Principle Requires Businesses To Report Chegg Com

Accounting 1 Flashcards Quizlet

Solved The Matching Principle Requires Businesses To Report Chegg Com

Solved The Matching Principle Requires Businesses To Report Chegg Com

0 Comments